Renting vs Buying?

Renting vs. Buying: Which Option is Right for You?

Deciding whether to rent or buy a home is one of the most significant financial decisions you’ll make. Both options come with their own set of advantages and considerations, and the best choice depends on your unique circumstances, goals, and lifestyle. Here’s a closer look at the pros and cons of renting versus buying to help you make an informed decision.

Benefits of Renting

-

Flexibility: Renting offers the freedom to move more frequently, making it ideal for those with unpredictable job locations or who aren’t ready to settle down.

-

Lower Upfront Costs: Typically, renting requires only a security deposit and the first month’s rent, unlike buying, which often involves a significant down payment and closing costs.

-

Less Responsibility: Maintenance and repairs are usually the landlord’s responsibility, saving renters time and money.

-

Predictable Expenses: Rent payments are consistent, and renters don’t have to worry about unexpected property repairs or market fluctuations.

Drawbacks of Renting

-

No Equity: Rent payments do not contribute to homeownership or building equity.

-

Limited Control: Renters must abide by the landlord’s rules and may face restrictions on personalization or renovations.

-

Rent Increases: Lease renewals can bring higher rent, impacting long-term affordability.

Benefits of Buying

-

Equity Building: Monthly mortgage payments build equity, offering a long-term financial asset.

-

Stability: Owning a home provides stability, especially for families or those who plan to stay in one place for an extended period.

-

Creative Freedom: Homeowners can renovate, decorate, and make changes to their property without seeking approval.

-

Tax Benefits: Mortgage interest and property taxes may be tax-deductible, offering financial advantages.

Drawbacks of Buying

-

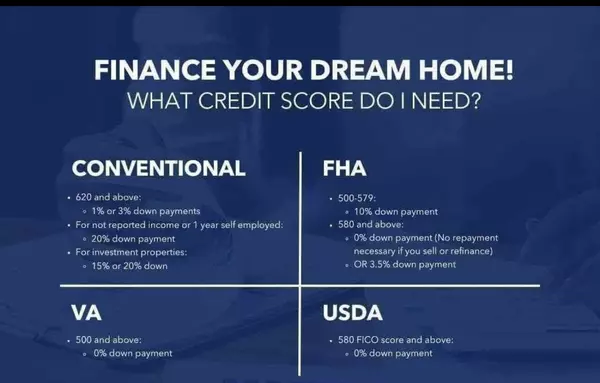

Higher Upfront Costs: Buying requires a down payment, closing costs, and other fees.

-

Responsibility for Maintenance: Homeowners are responsible for all repairs and upkeep, which can be costly and time-consuming.

-

Market Risk: Property values can fluctuate, potentially impacting your investment.

-

Less Flexibility: Selling a home and moving is a more complicated and lengthy process than ending a rental lease.

Questions to Ask Yourself

-

How Long Do You Plan to Stay? If you’re planning to stay in one place for several years, buying may be more cost-effective. For shorter stays, renting is often the better option.

-

What’s Your Financial Situation? Consider your savings for a down payment, monthly budget, and ability to handle unexpected expenses.

-

What Are Your Lifestyle Priorities? Do you value flexibility and low responsibility, or are you seeking stability and creative control?

Final Thoughts

There’s no one-size-fits-all answer to the renting vs. buying debate. Your decision should align with your financial situation, lifestyle, and future plans. Whether you’re ready to plant roots or prefer the flexibility of renting, understanding the pros and cons can help you choose the best path forward.

Need personalized advice? Contact me today to discuss your options and find the perfect place to call home, whether you decide to rent or buy!

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

GET MORE INFORMATION